Summary

- Understanding Your Motivation and Purpose

- Gaining Industry Knowledge

- Identifying Your Target Market

- Creating a Solid Business Plan

- Choosing a Legal Structure

- Setting Up Your Office

- Integrating Technology

- Marketing Your Firm

- Building a Client Base

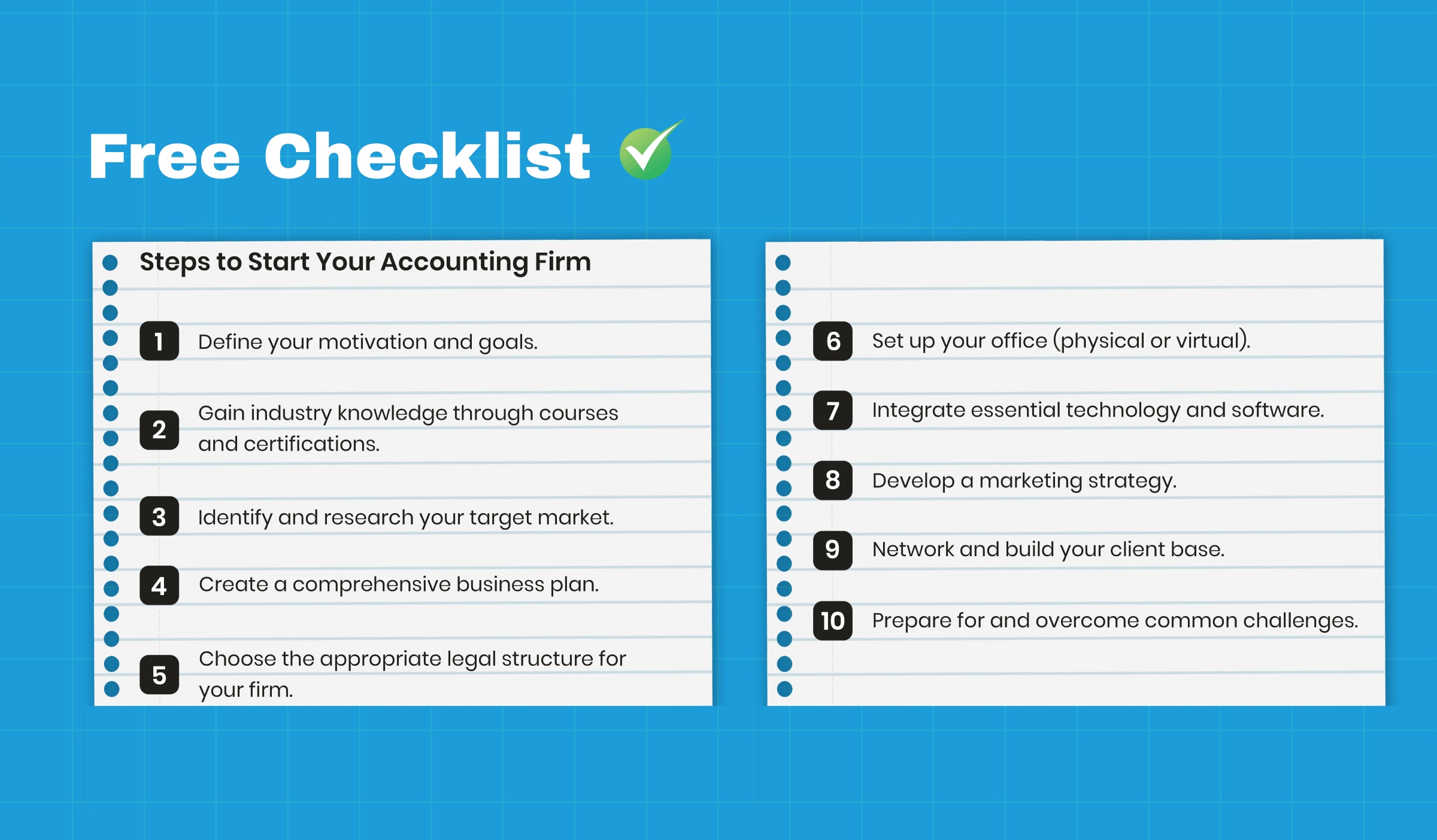

- Free Checklist: Steps to Start Your Accounting Firm

- Conclusion

Understanding Your Motivation and Purpose 01

01. Defining Your Long-Term Goals

Establishing clear, long-term goals is vital for the success of your accounting firm. Consider what you envision for your business in the next five to ten years. Do you aspire to expand your firm to include specialized services, such as outsourced bookkeeping and accounting or remote accounting services? Are you aiming to build a team of expert accountants who share your vision? By articulating your long-term goals, you create a roadmap that guides your decision-making processes and helps measure your progress.

02. Creating a Vision Statement

A well-crafted vision statement encapsulates your aspirations and purpose. It serves as a motivational tool for you and your team, providing clarity on what your firm stands for and the impact you want to make in the accounting industry. Your vision might focus on aspects like providing unparalleled customer service, fostering strong relationships with clients, or being a leader in innovative accounting practices. This statement will not only define your firm's identity but also attract clients who resonate with your values.

03. Identifying Your Target Market

Understanding your motivation also extends to defining your target market. Are you inclined to serve local small businesses, freelancers, or specific industries like real estate or technology? Each market has unique financial challenges and opportunities, so aligning your motivations with a specific target demographic will enable you to tailor your services effectively. Conducting market research to assess the needs and preferences of your potential clients can further refine your focus, ensuring that your firm addresses real-world challenges and delivers meaningful solutions.

04. Staying Committed to Your Purpose

As you embark on this journey, remember that challenges will arise. Staying committed to your core motivation and purpose will help you navigate obstacles and maintain your focus. It’s essential to remain adaptable and open to feedback as you grow, while always keeping your initial vision in mind. This dedication not only fuels your personal motivation but also inspires confidence in your clients, fostering long-term relationships built on trust and reliability.

Gaining Industry Knowledge 02

01. Embrace Continuous Learning

The accounting profession is marked by constant changes in regulations, technologies, and client expectations. Embracing a mindset of continuous learning is fundamental to staying ahead. Consider enrolling in online courses that cover essential topics such as tax laws, auditing standards, and accounting software. Obtaining relevant certifications, such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant), can also enhance your credibility and open doors to new opportunities.

02. Stay Updated with Industry Trends

Being proactive in your learning journey includes staying updated on industry trends and regulatory changes. Subscribing to reputable accounting publications, such as the Journal of Accountancy or CPA Practice Advisor, will keep you informed about the latest news, case studies, and best practices. Many of these publications also offer newsletters, making it easy to receive timely updates directly in your inbox.

In addition, attending webinars and industry conferences can provide valuable insights and networking opportunities. These events often feature expert speakers who share their knowledge on emerging trends, challenges, and innovative solutions in the accounting field. Participating in professional organizations, such as the American Institute of CPAs (AICPA) or state CPA societies, can further enhance your network and provide access to resources that support your growth.

03. Leverage Technology and Resources

As you build your knowledge base, leverage technology to your advantage. There are numerous resources available online, including forums, podcasts, and blogs dedicated to accounting and finance. Engaging with these platforms can expose you to diverse perspectives and practical tips that can be applied in your firm. Consider joining accounting-focused online communities or social media groups where professionals share insights, answer questions, and support one another.

04. Develop a Knowledge Network

Building a network of knowledgeable contacts within the accounting industry can be incredibly beneficial. Connect with experienced accountants, mentors, or industry peers who can provide guidance and share their experiences. Networking not only allows you to gain insights but also opens doors for collaboration and potential referrals as you establish your firm.

05. Commit to Lifelong Learning

Finally, make a commitment to lifelong learning. The accounting profession demands adaptability, and being open to new knowledge will serve you well in your entrepreneurial journey. Regularly assess your skill set and identify areas for improvement or specialization. By prioritizing education and knowledge, you’ll not only enhance your expertise but also position your firm as a trusted resource for clients seeking comprehensive accounting solutions.

Identifying Your Target Market 03

01. Understanding the Needs of Your Target Market

Every market segment has distinct characteristics and requirements. For instance, small businesses may prioritize affordable outsourced bookkeeping and accounting services that fit their budget, while larger corporations may seek comprehensive financial strategies and in-depth reporting. To accurately identify your target market, conduct thorough market research to uncover the specific needs and pain points of potential clients. Surveys, interviews, and industry reports can provide valuable insights that inform your service offerings and marketing strategies.

Key Services to Offer

Once you’ve established your target market, consider the key services that will resonate with them. Some essential services to contemplate include:

- Outsourced Bookkeeping and Accounting Services: Many small businesses struggle to maintain accurate financial records. Offering tailored solutions can alleviate their burden and allow them to focus on core operations.

- Tax Preparation: Tax regulations can be complex and time-consuming for business owners. Providing expert tax preparation services can help clients navigate their obligations while ensuring compliance and maximizing potential deductions.

- Financial Planning: Helping businesses develop comprehensive financial strategies not only enhances their stability but also positions you as a trusted advisor. This service can include budgeting, forecasting, and investment advice tailored to the specific goals of your clients.

- Specialized Industry Services: Consider focusing on niche markets, such as real estate, healthcare, or technology. Designed expertise in these areas can set you apart as a go-to resource for clients seeking specialized knowledge.

02. Building Your Reputation as an Expert

A clear niche simplifies your marketing efforts and allows you to concentrate your resources on attracting the right clients. It also enables you to build a solid reputation as an expert in your chosen area. By delivering high-quality services and demonstrating your industry knowledge, you’ll cultivate trust with your clients, making them more likely to refer you to others.

Engaging in thought leadership activities, such as writing articles, giving presentations, or hosting webinars, can further enhance your visibility within your target market. Sharing valuable insights and practical advice showcases your expertise and positions your firm as a reliable resource for prospective clients.

03. Shaping Your Marketing Strategy

Once you've defined your target market and service offerings, adapt your marketing strategy accordingly. Utilize SEO-friendly content on your website and Accounting and Tax blog to attract your ideal clients, focusing on keywords relevant to their needs, such as outsourced accounting services and tax consultancy for small businesses. Leverage social media platforms to connect with potential clients and engage in conversations about industry trends and challenges.

By thoughtfully identifying and understanding your target market, you can create a strong foundation for your accounting firm, ensuring your services align with client needs and establishing a reputation for excellence in your niche.

Take the first step toward building

your accounting firm with confidence.

Contact Unison Globus today to explore how our

expert guidance and resources can help you

succeed in the accounting industry!

Creating a Solid Business Plan 04

01. Define Your Mission and Vision

At the heart of your business plan should be your mission and vision statements. These articulate what your firm stands for and the impact you aim to make within the accounting industry. Your mission should clearly express your firm's purpose—whether it’s providing exceptional outsourced accounting services or supporting small businesses with tailored financial solutions. Your vision should outline your long-term aspirations, guiding your strategic decisions and inspiring your team.

02. Detail Your Service Offerings

Clearly defining your service offerings is essential for positioning your firm in the marketplace. Highlighting services such as remote bookkeeping solutions, tax preparation, and financial consulting can attract potential clients looking for modern, efficient options. Each service should be accompanied by a description of its benefits, demonstrating how you can meet the specific needs of your target market. For example, explain how your outsourced bookkeeping services can save clients time and reduce stress, allowing them to focus on their core business operations.

03. Market Analysis

A comprehensive market analysis is a critical component of your business plan. This section should include information on industry trends, target demographics, and competitive analysis. Understanding the landscape will help you identify opportunities for growth and areas where your firm can differentiate itself. Analyze competitors’ strengths and weaknesses to find gaps in the market that your firm can fill, such as offering niche services or exceptional customer support.

04. Financial Projections

Financial projections provide a clear picture of your firm’s anticipated performance over the next few years. Include detailed forecasts of your income, expenses, and cash flow. This section is essential for potential investors or lenders, as it demonstrates your understanding of the financial aspects of running a business. Be realistic with your projections, considering factors such as startup costs, pricing strategies, and expected growth. Break down your financial goals into actionable milestones to track your progress effectively.

05. Funding and Investment Strategy

If you plan to seek funding or investment, outline your strategy in this section. Detail how much capital you need, how you intend to use it, and what return investors can expect. Providing a clear funding strategy not only enhances your credibility but also reassures potential investors that you have a solid plan for growth. Highlight your unique value proposition, such as your expertise in outsourced bookkeeping and accounting, to make your firm appealing to investors.

06. Operational Plan

An operational plan outlines the day-to-day functions of your accounting firm. This section should detail your staffing needs, office setup (whether physical or virtual), and technology requirements. Discuss the systems and processes you will implement to ensure efficiency and effectiveness, such as project management tools, accounting software, and client relationship management systems. A well-thought-out operational plan helps demonstrate that you are prepared to handle the complexities of running an accounting firm.

07. Review and Revise

Creating a business plan is not a one-time task; it should be a living document that evolves as your firm grows. Regularly review and revise your plan to reflect changes in the market, shifts in your business strategy, or advancements in technology. Being adaptable and responsive to new information will help you stay ahead of the competition and ensure the long-term success of your firm.

By dedicating the time and effort to create a solid business plan, you lay the groundwork for a successful accounting firm. This document will not only guide your operations but also serve as a powerful tool for attracting clients and securing investments.

Choosing a Legal Structure 05

01. Sole Proprietorship

Operating as a sole proprietorship is the simplest and most common structure for small business owners, particularly for those starting out in the accounting field. This structure allows you to have complete control over your firm and its operations.

Pros:

- Simplicity: Setting up a sole proprietorship is straightforward and requires minimal paperwork.

- Full Control: As the sole owner, you make all the decisions and retain all profits.

- Tax Benefits: Income is reported on your personal tax return, potentially simplifying your tax obligations.

Cons:

- Unlimited Liability: One of the most significant drawbacks is that you are personally liable for all debts and legal obligations of the business. This means your personal assets could be at risk in the event of a lawsuit or financial difficulties.

- Limited Growth Potential: Raising capital can be challenging, as you may rely solely on personal funds or loans.

02. Limited Liability Company (LLC)

An LLC is a popular choice for many new accounting firms because it provides liability protection while allowing for flexibility in management and taxation.

Pros:

- Liability Protection: An LLC shields your personal assets from business liabilities, meaning your personal finances are generally protected in case of lawsuits or debts incurred by the business.

- Tax Flexibility: An LLC can choose to be taxed as a sole proprietorship, partnership, or corporation, providing options to optimize your tax situation.

- Professional Credibility: Operating as an LLC can enhance your firm's credibility with clients, as it signals a commitment to professionalism.

Cons:

- Formation Costs: Establishing an LLC typically involves filing fees and additional paperwork compared to a sole proprietorship.

- Ongoing Requirements: Depending on your state, there may be ongoing compliance requirements, such as annual reports or fees.

03. Partnership

If you’re planning to start your accounting firm with one or more partners, forming a partnership can be an effective structure. Partnerships can be general or limited, depending on the roles and liabilities of each partner.

Pros:

- Shared Resources and Expertise: Partnerships allow you to pool resources, skills, and knowledge, potentially leading to a stronger firm.

- Simplified Taxation: Like sole proprietorships, partnerships typically do not pay income tax at the business level. Instead, profits and losses are passed over to the partners’ individual tax returns.

Cons:

- Shared Liability: In a general partnership, all partners share liability for the business's debts and obligations, which can expose personal assets.

- Potential for Disputes: Partnerships require a strong foundation of trust and clear communication to avoid conflicts that can arise from differing opinions or business decisions.

04. Making the Right Choice

When selecting the legal structure for your accounting firm, consider factors such as your business goals, financial situation, and the level of risk you’re willing to take. It’s essential to consult with legal and financial advisors to understand the implications of each structure fully. They can help you evaluate the benefits and drawbacks based on your specific circumstances and guide you in making an informed decision.

Ultimately, the right legal structure will not only protect your personal assets but also position your firm for growth and success. As you move forward, keep in mind that you can always adjust your legal structure as your business evolves, allowing you to remain flexible and responsive to changing circumstances.

Setting Up Your Office 06

01. Physical Office vs. Virtual Office

Choosing a physical office offers a traditional approach, allowing you to create a dedicated space where you can meet clients, collaborate with team members, and maintain a professional presence. However, this option often comes with higher overhead costs, including rent, utilities, and maintenance.

On the other hand, a virtual office has become increasingly popular among accounting firms, thanks to advancements in technology. This model allows for reduced overhead expenses while providing greater flexibility for both employees and clients. Many firms find that a virtual setup not only enhances work-life balance for their teams but also enables them to attract talent from a wider geographical area.

02. Benefits of a Virtual Office

Once you’ve established your target market, consider the key services that will resonate with them. Some essential services to contemplate include:

03. Setting Up Your Physical Office

If you choose to establish a physical office, consider the following essential components:

04. Creating an Efficient Workflow

Regardless of the office setup you choose, it’s important to create an environment that fosters productivity and collaboration. Implement efficient workflows and utilize project management tools to streamline communication among team members. Cloud-based platforms allow for real-time collaboration, making it easier for your team to share documents and updates.

05. Essential Software and Tools

Equipping your office with the right software is essential for handling accounting tasks effectively. In addition to accounting software like QuickBooks or Xero, consider incorporating tools for:

06. Preparing for Future Growth

As your firm grows, be prepared to adapt your office setup to accommodate changing needs. Whether that means transitioning to a hybrid model or expanding your physical office space, staying flexible will ensure your firm remains agile in the face of growth.

In conclusion, the decision between a physical or virtual office should align with your firm’s vision, budget, and operational goals. By thoughtfully considering your options and equipping your office with the necessary tools, you set a strong foundation for your accounting firm’s success.

Are you ready to transform your vision into reality?

Partner with Unison Globus for personalized support and insights as you establish your accounting firm. Let’s embark on this journey together!

Get in Touch!

Integrating Technology 07

01. Choosing the Right Accounting Software

Selecting the right accounting software can significantly impact your firm’s efficiency and effectiveness. Look for solutions that streamline financial management processes and allow for real-time data access. Popular options like QuickBooks and Xero provide a range of features tailored to meet the needs of small to medium-sized businesses.

- QuickBooks: This user-friendly platform offers robust functionalities for invoicing, expense tracking, payroll management, and financial reporting. Its extensive integrations with other applications make it a versatile choice for accounting firms.

- Xero: Known for its intuitive interface, Xero provides comprehensive accounting tools, including bank reconciliation, expense claims, and reporting features. Its cloud-based nature allows for collaboration with clients and team members in real time, enhancing communication and efficiency.

02. Embracing Cloud-Based Solutions

Transitioning to cloud-based accounting solutions offers numerous advantages for your firm. Cloud technology ensures that your data is securely stored and accessible from anywhere, providing flexibility in how you operate. This is particularly beneficial for remote work environments, enabling you to manage client accounts, access financial reports, and collaborate with your team seamlessly.

- Scalability: Cloud solutions can easily scale with your business as it grows, accommodating increased data storage needs and additional users without the hassle of upgrading hardware or software.

- Enhanced Security: Reputable cloud providers invest heavily in security measures, protecting sensitive financial data from unauthorized access and potential breaches. Regular backups and disaster recovery options further safeguard your firm’s information.

03. Automating Routine Tasks

Integrating technology also allows you to automate routine accounting tasks, freeing up time for more strategic activities. For example, automated invoicing can ensure timely billing, while recurring payment features simplify the accounts receivable process. Consider implementing tools that automate payroll, tax calculations, and financial reporting, significantly reducing manual errors and saving valuable time.

04. Utilizing Client Portals

Establishing client portals is another effective way to integrate technology into your accounting practice. These secure online platforms enable clients to upload documents, access financial reports, and communicate with your team. Providing a seamless client experience enhances customer satisfaction and fosters trust, making your firm more appealing to prospective clients.

05. Staying Informed About Technological Advances

The accounting technology landscape is continually evolving, so staying informed about the latest advancements is crucial. Subscribe to industry publications, attend webinars, and participate in conferences to learn about emerging tools and software. Engaging with peers in professional networks can also provide insights into best practices and innovative solutions that enhance your firm’s operations.

06. Investing in Training and Support

As you integrate new technology, ensure that you invest in training for yourself and your team. Familiarity with the software and tools will maximize their potential and streamline your firm’s workflows. Consider utilizing online tutorials, vendor-provided training sessions, or industry-specific courses to boost your team’s proficiency.

By embracing technology and integrating it effectively into your accounting firm, you position yourself for long-term success. The right tools not only enhance productivity and accuracy but also allow your firm to remain agile and adaptable in a rapidly changing industry.

Marketing Your Firm 08

01. Build a Professional Website

Your website completes as the digital storefront for your accounting firm. It should clearly highlight your services, expertise, and unique value proposition. Ensure your website is user-friendly and optimized for both desktop and mobile devices. Key elements to include are:

- Service

Descriptions: Clearly outline the accounting services you offer, such as tax preparation, financial planning, and remote bookkeeping solutions. Be specific about how your services can meet the needs of your target market. - Testimonials and Case Studies: Showcase positive feedback from satisfied clients to build trust with potential customers. Real-life examples of how you’ve helped clients achieve their financial goals can make a significant impact.

- Blog

Content: Regularly updating your website with informative blog posts not only positions you as an expert in the field but also improves your site’s search engine optimization (SEO). Use relevant keywords, such as outsourced accounting services and accounting firm checklist, to attract organic traffic.

02. Leverage Social Media Platforms

Social media is a effective tool for increasing visibility and engaging with potential clients. Choose platforms that align with your target market, such as LinkedIn, Facebook, or Instagram. Consider the following strategies:

- Share Valuable Content: Post articles, tips, and industry news that provide value to your audience. Sharing insights related to accounting trends or tax updates can position you as a knowledgeable resource.

- Engage with Your Audience: Reply to comments and messages quickly to foster engagement. Participate in significant discussions and groups to connect with potential clients and demonstrate your expertise.

- Run Targeted Ads: Utilize social media advertising to reach a broader audience. Running targeted ads can help you attract specific demographics that align with your ideal client profile.

03. Utilize Email Marketing

Email marketing continues one of the most effective ways to foster leads and maintain relationships with clients. Create a mailing list and send regular newsletters that include:

- Industry Updates: Share news about changes in tax laws, accounting practices, or industry trends to keep your audience informed.

- Service Promotions: Highlight your services, special offers, or new service launches to encourage clients to reach out.

- Client Success Stories: Showcase case studies that illustrate how your services have benefited clients, reinforcing your firm’s value.

04. Network Offline

While online marketing is crucial, offline strategies should not be overlooked. Building relationships within your community can significantly boost your firm’s reputation. Consider these approaches:

- Attend Industry

Events: Participate in accounting conferences, workshops, or local business expos to network with other professionals. These events provide opportunities to meet potential clients and establish valuable connections. - Join Professional Organizations: Becoming a member of accounting associations or local chambers of commerce can enhance your credibility and expand your network. Engage in community events to raise awareness of your firm.

- Collaborate with Local Businesses: Partner with other businesses that complement your services, such as legal firms or financial advisors. Cross-promotions can introduce your firm to new audiences.

05. Monitor and Adjust Your Strategy

As you implement your marketing strategy, it’s essential to track your efforts and measure their effectiveness. Use tools like Google Analytics to assess website traffic and user behavior. Monitor your social media engagement and email open rates to understand what resonates with your audience. Based on the data, be prepared to adjust your strategy to optimize results continually.

In conclusion, a comprehensive marketing strategy that combines online and offline efforts is vital for attracting clients to your accounting firm. By establishing a professional online presence, engaging with your audience, and building relationships within your community, you can create a strong foundation for your firm's growth and success.

Your accounting firm

journey starts here!

Reach out to Unison Globus and discover how our professional expertise in accounting, taxation, and outsourcing can empower you to achieve your business goals!

ContactBuilding a Client Base 09

- Attend Industry Conferences: Participate in relevant events to connect with potential clients and industry peers. These gatherings provide opportunities to showcase your expertise and expand your professional network.

- Join Professional Groups: Engage with local or national accounting associations to meet other professionals and gain insights into best practices. Membership often offers access to resources and networking events.

- Ask for Referrals: Don’t hesitate to request referrals from satisfied clients or industry contacts. Word-of-mouth recommendations are powerful and can significantly enhance your credibility.

- Establish Partnerships: Collaborate with other firms that offer complementary services, such as legal or tax advisory practices. These partnerships can start to common referrals and broaden your client base.

01. Overcoming Challenges

Starting an accounting firm without prior experience presents a unique set of challenges. However, with the right mindset and strategies, you can effectively navigate these hurdles and build a successful practice. Here are some general challenges and tips for defeating them:

02. Managing Client Expectations

One of the most significant challenges you may face is managing client expectations. Clients often expect timely communication, transparency, and exceptional service. To address this, establish clear communication channels from the start and set realistic timelines for deliverables. Regularly update clients on their account status and be proactive in addressing any concerns they may have.

03. Keeping Up with Industry Changes

The accounting landscape is constantly evolving, with new regulations, technologies, and best practices emerging regularly. Staying informed is crucial for maintaining your firm's relevance. Commit to continuous learning through online courses, webinars, and industry publications. Joining professional organizations can also provide access to valuable resources and networking opportunities.

04. Building Confidence and Credibility

As a new firm owner, you may struggle with self-doubt or a lack of credibility. Overcoming this requires perseverance and a commitment to building your expertise. Leverage testimonials from satisfied clients, share success stories, and engage in thought leadership by writing articles or participating in webinars. Gradually, as you demonstrate your knowledge and skills, you will build trust with both clients and colleagues.

05. Developing a Strong Support System

Entrepreneurship can be isolating, so it’s essential to have a solid support system. Seek out mentors or join peer groups to share experiences and advice. Mentors can provide invaluable insights based on their own experiences, while peer groups can offer encouragement and accountability. Engaging with a community of like-minded professionals can help you navigate the challenges of starting and running your firm.

06. Staying Patient and Resilient

Success in the accounting industry doesn’t happen overnight. It requires patience, resilience, and a willingness to learn from setbacks. Accept challenges as opportunities for growth, and remember that determination is key. Reflect on your progress regularly, celebrate small wins, and remain focused on your long-term goals. By being prepared for these challenges and implementing strategies to overcome them, you’ll be better equipped to navigate the complexities of starting your accounting firm. With resilience and a commitment to continuous learning, you can turn obstacles into stepping stones on your path to success.

Free Checklist: Steps to Start Your Accounting Firm